The auto-driving policy of the industry has been intensively implemented, and pressing the "acceleration button" at L3 level is expected to lead a new round of intelligent driving?

Autopilot has attracted much attention recently.

According to the Securities Times, before the US stock market closed on Monday, Morgan Stanley released a research report saying that Tesla was used.Dojo Supercomputer for Training Autopilot System of AutomobileMight make the companyThe market value has increased by as much as $500 billion.. According to the research report, Dojo supercomputer can open up a "new potential market" for Tesla. On this basis, analysts upgraded Tesla’s rating from "holding" to "over-matching" and raised the target price for the next 12 months from $250 to $400.

Institutional analysts pointed out that Tesla’s share price still has a large room for growth, and software and services have become Tesla’s biggest value drivers, which are truly realized."Soft and hard take all". In July this year, Musk said at the company’s earnings conference that Dojo had started production and was considering authorizing its FSD(Full Self-Drive) hardware and software to other car manufacturers.

As soon as the news came out, the US stock price of Tesla was the same day.Up 10.09%, closed at $273.58 per share, with a total market value of $868.3 billion, soaring nearly $80 billion a day (about RMB 580 billion).

Tesla news also blew the benefits to the A-share related concepts, which resonated with the recent news of intensive domestic autopilot policies, stimulating the sector to continue to rise.According to the Wind financial terminal, the Wind Driverless Index (884162) fluctuated and rose this year. After hitting an intraday high of nearly a year on July 12, it experienced a callback for nearly a month. It began to stabilize and rebound on August 28 and closed on September 12.The range rose by more than 12%.

(Source: Wind)

(Source: Wind)

In terms of financial performance,A-share smart driving concept stocks generally reported good results in the first half of the year.Among the 38 smart driving concept stocks, 28 companies achieved profitability in the first half of the year, accounting for over 70%. Among them, the net profit of Baolong Technology, Guangting Information, Daotong Technology and Asia Pacific Shares doubled year-on-year; Huayu Automobile, Top Group and Desai Siwei are the top three in terms of profit scale.

CITICSThe research report pointed out that global resonance,The domestic smart driving market is welcoming three turning points.:

1) Technically:Tesla’s "BEV+Transformer+ Data Closed Loop" model began to get on the bus in 2023, making it possible to navigate the city without relying on high-precision maps;

2) Commercialization:It is expected that the urban navigation function of various car companies will be intensively implemented from Q4 in 2023, and some of them will no longer rely on high-precision maps, and the commercialization of FSD in North America and its entry into China are also expected to accelerate;

3) Policy:Recently, the L3 autopilot policy has been intensively implemented, and the follow-up is expected to continue to heat up. It is expected that the above three turning points are expected to be realized one after another from September to early next year, leading a new round of smart driving.

The policy has been intensively implemented, and the L3 level has been "accelerated"

Recently, policies have been intensively implemented, and many attempts have been made to develop test roads to promote the improvement of the autonomous driving market. The industrial chain is experiencing an important link of entering a high-level stage.

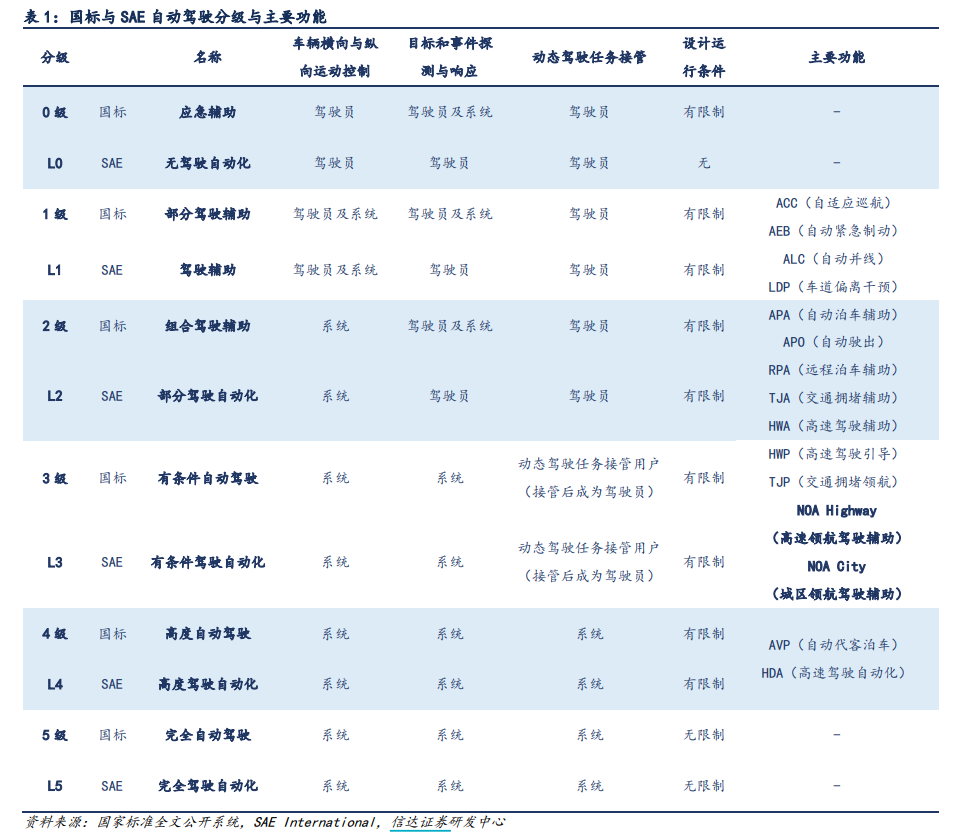

Cinda securitiesIt is pointed out that L3, as the key node of assisted driving towards automatic driving, is currentlyThe domestic industry is in an important stage of transition from L2 to L3.L3 stage representative functions such as high speed and NOA(Navigate On Autopilot) have gradually begun to land.

(Source: Cinda Securities)

(Source: Cinda Securities)

Chuancai securitiesIt is pointed out that the assisted intelligent driving market in China is becoming more and more popular, and consumers’ awareness of this function is increasing. Under this background, the government has vigorously strengthened the integrated development of vehicles and Lu Yun. The auto-related sectors related to intelligent networking mainly include auto parts sectors such as chip sensors, and we are optimistic about the future incremental space of related sectors.

Domestic companies actively deploy high-level smart drivers, and large models are rapidly promoted.

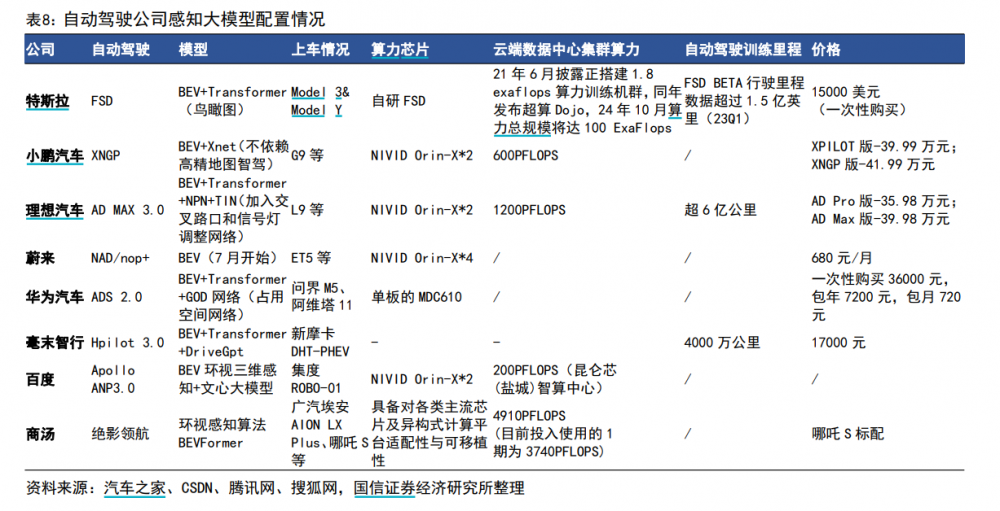

1 Tesla leads, and the new forces of building cars actively follow up the big model data.

Under the application of Tesla’s "BEV+Transformer+ Data Closed Loop" model, the technical feature of Tesla FSD is to remove most radars, which provides technical feasibility for light mapping. Among them, BEV is a bird’s-eye view. After the 3D information is obtained by the sensing sensor, it is interacted and fused with each image feature through the multi-layer Transformer, and finally the BEV feature is obtained. Not only can the spatial information be supplemented, but also the static target can be processed more efficiently.

Under the guidance of Tesla’s trend of "light map" and "heavy perception"Many companies in China, such as Huawei, Tucki and LI, have also begun to explore getting rid of the pilot driving of high-precision maps and actively lay out the development of large models.

Guoxin SecuritiesIt is pointed out that the landing of large model is expected to effectively improve user stickiness, and the company’s investment willingness is expected to be strong.Drive the upstream and downstream of the car industry chain to fully benefit..

(Source: Guosen Securities)

(Source: Guosen Securities)

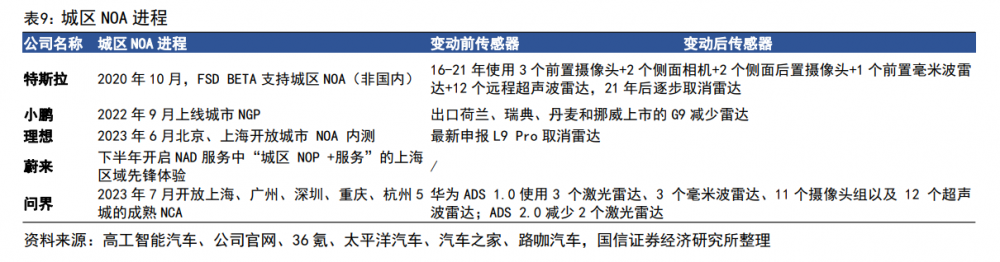

(2) The large model helps to reduce the cost, and the NOA market in urban areas can be expected.

(Source: Guosen Securities)

(Source: Guosen Securities)

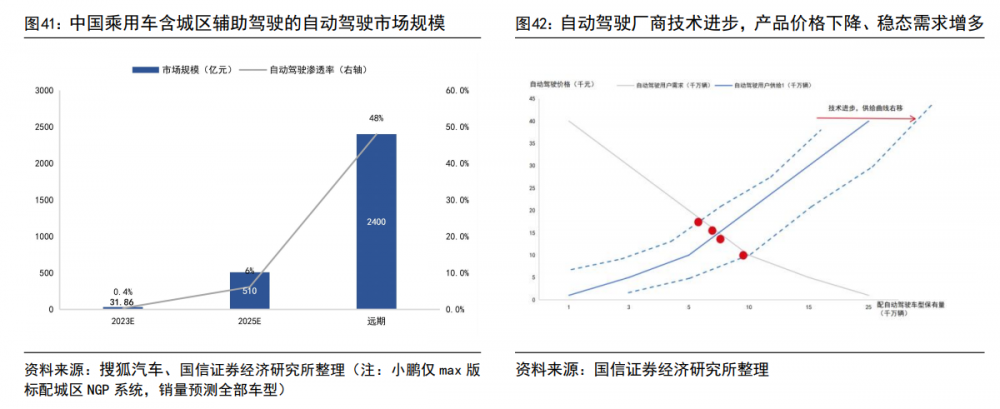

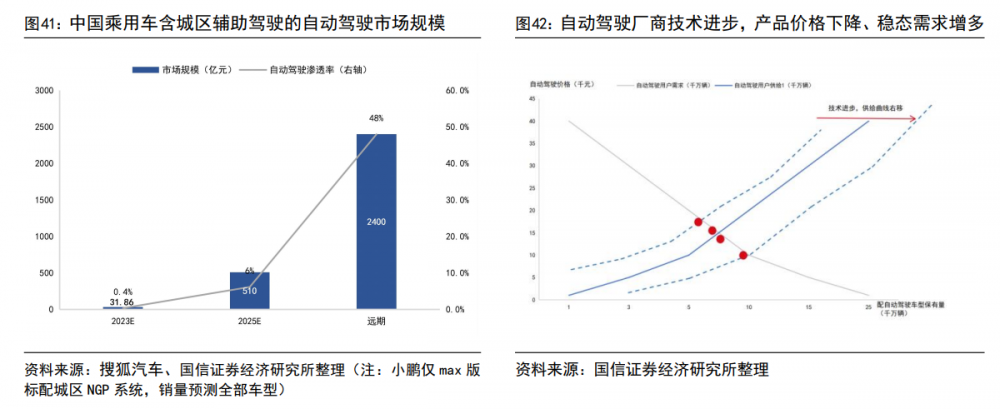

Guoxin SecuritiesIt is estimated that in 2025, the penetration rate of autonomous driving with urban assisted driving function will increase from the current 0.4% to 6%.In 2025, the domestic autonomous driving market with urban driving assistance function will be 51 billion yuan.. In the long run, the market scale will continue to increase with technological progress.

(Source: Guosen Securities)

(Source: Guosen Securities)

(3) The landing of large model promotes the hardware reform of intelligent driving.

Dongguan securitiesIt is pointed out that with the continuous improvement of the penetration rate of intelligent driving, as an important execution system in the field of intelligent driving, brake-by-wire has entered a period of rapid growth. With the continuous iterative upgrade of product technology,Domestic brake by wireIt is expected to achieve a breakthrough on the new track.

(Source: Guosen Securities)

(Source: Guosen Securities)

Institutional concern

1) vehicle-mounted high-speed communication:Dianlian Technology, Long Xun, Yutaiwei, Chuangyao Technology;

2) Relevant targets of domain control and localization of Horizon chip:Tianzhun Technology, Desai Siwei, Junsheng Electronics, Jingwei Hengrun;

3) Intelligent driving visual sensor:Lianchuang Electronics, Weir, Stevie, Gekewei, Jingfang Technology;

4)4D millimeter wave radar:Jingwei Hengrun, Weifu Hi-Tech, United Optoelectronics;

5) Lidar:Changguang Huaxin, Juguang Technology, Yongxin Optics.

1) Independent brand intelligent leading car enterprises:BYD, Changan Automobile, SAIC, Guangzhou Automobile Group, etc.

2) New forces in building cars:Xpeng Motors, LI, etc.

3) Global leader in new energy vehicles:Tesla

1) Decision-making level:Desai Siwei, Coboda, Junsheng Electronics;

2) Algorithm layer:Xpeng Motors;

three) executive layer:Bethel, baolong technology.

(Report source: Cinda Securities, Guosen Securities, Debon Securities, CITIC Securities, Dongguan Securities, Chuancai Securities)

(The information in this article does not constitute any investment advice. The published content comes from licensed securities institutions and does not represent the platform’s point of view. Investors are requested to make independent judgments and decisions. )