Big reversal! Good shops sue "Zhao Yiming", the biggest merger or fraud in the snack industry?

This article is 4022 words, about 5.7 minutes.

Author | Gardenia Editor | We

Source | Rongzhong Finance

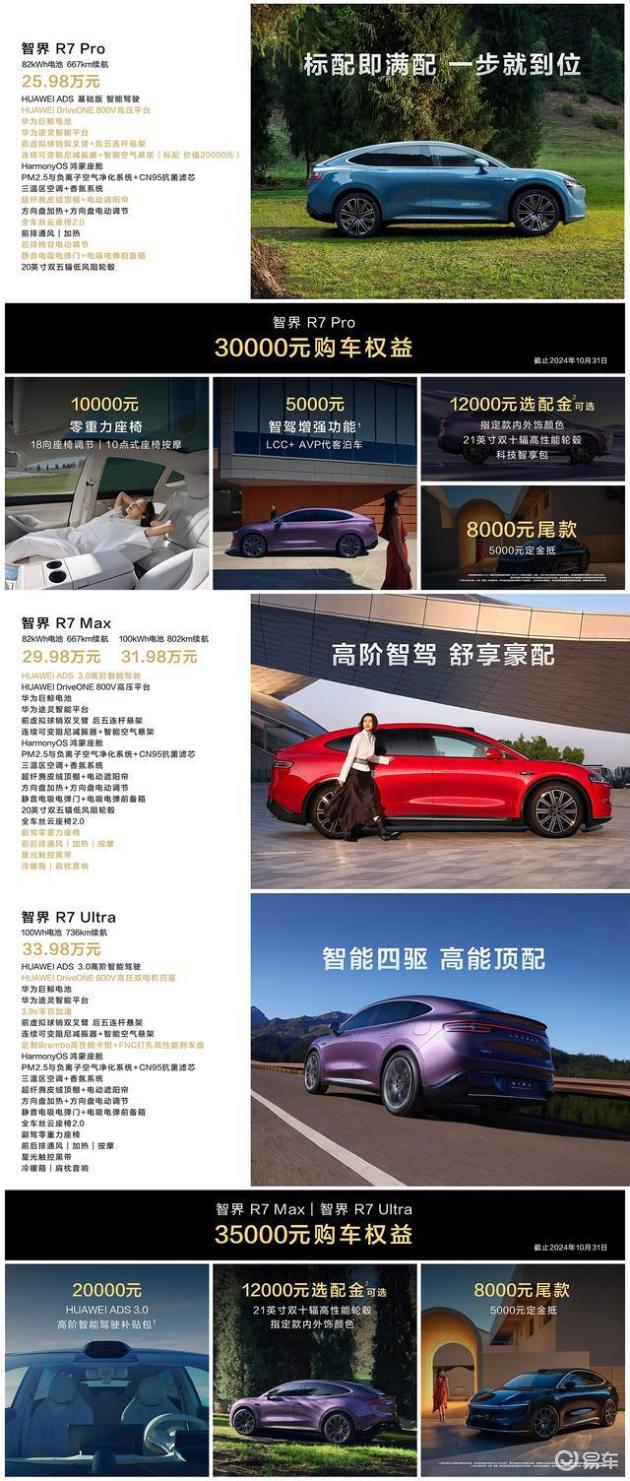

It thundered on the ground! "Snacks are Busy" and "Zhao Yiming" announced the merger of the head players in this mass snack industry. The news fever has not dissipated, and the lawsuit is coming!

On December 6th, according to media reports, "Liangpin Shop sued Zhao Yiming: Deliberately concealing major events of the company and damaging minority shareholders’ right to know". Judging from the specific information, Ningbo Guangyuan Juyi Investment Co., Ltd. (hereinafter referred to as "Guangyuan Juyi"), a wholly-owned subsidiary of Liangpin Shop, was invested by Yichun Zhao Yiming Food Technology Co., Ltd. (hereinafter referred to as "Zhao Yiming") during the cooperation period between the two parties.Deliberately concealing major events of the company, damaging minority shareholders’ right to know,On November 27, he formally filed a lawsuit with the people’s court. At present, the court has accepted the case.

Zhao Yiming Snacks was established in 2019, and in February, 2023, it was favored by good shops, which invested 45 million yuan through its subsidiary "Guangyuan Juyi". Enterprise investigation shows that at that time, it was financed by 150 million yuan led by Black Ant Capital and invested by good shops, with a valuation of about 1.5 billion yuan. After the completion of financing, it began to accelerate its expansion.

Only half a year later, on October 17th this year, Liangpin Store announced that Ningbo Guangyuan Juyi Investment Co., Ltd., a wholly-owned subsidiary, planned to transfer its 3% equity of Yichun Zhao Yiming Food Technology Co., Ltd. (hereinafter referred to as Zhao Yiming) for a total price of about 105 million yuan. The good shop chose clearance.

The huge market volume of discount snacks and every change in the industry may lead to the actual interests of thousands of investors and franchisees behind them. As early as before the merger of Busy Snacks and Zhao Yiming, there were investors arguing about Busy Snacks and the investment value of Zhao Yiming.

Undoubtedly, this complaint once again put Snacks Busy and Zhao Yiming on the front page of the industry public opinion and even the investment circle.

In the media reports, Liangpin Store said that its investment was based on the original intention of achieving better development of its partners, but after the news of the merger was announced, it was deeply felt that it was maliciously deceived and its rights and interests were damaged.

Review the timeline.

On October 16th, Guangyuan Juyi transferred its 3% equity of Zhao Yiming Company to Shanghai Yihai Enterprise Management Consulting Partnership (hereinafter referred to as "Yihai Partnership") and Xiamen Heiyi No.3 Overseas Connection Venture Capital Partnership (hereinafter referred to as "Heiyi Partnership"). "Guangyuan Juyi" received all equity transfer funds on October 19, 2023.

In "Guangyuan Juyi"Only 22 days after the transfer of equity, that is, on November 10th, Zhao Yiming and Snacks were very busy to release a "merger" statement.According to the national enterprise information credit publicity system, both parties have completed the industrial and commercial change registration on the day of announcement.

From the perspective of the merged shareholding structure, Snacks Busy holds 87.76% of the shares in Zhao Yiming, while Zhao Ding, the founder of Zhao Yiming, holds 32% of the shares of Snacks Busy through Yichun Bird Nest Advertising Information Culture Communication Co., Ltd. and Yichun Bird Management Partnership (Limited Partnership), becoming the second largest shareholder of Snacks Busy.

It is worth noting that on September 28th this year, Wang Pingan, Zhao Ding and other "Zhao Yiming" executives completed the registration in Yuanzhou District, Yichun, one of the shareholding platforms for holding "snacks are very busy", and the executive partner of this enterprise appointed Zhao Ding as the representative.

"The Company Law clearly stipulates that Liangpin Store, as a shareholder of Zhao Yiming, has the right to know the important resolutions of Zhao Yiming, and enjoys the legal rights of knowing, making decisions, inspecting and preempting in such a major asset reorganization. If Zhao Yiming informs Liangpin Store of its busy merger plan with snacks, Liangpin Store will probably exercise its preemptive right.

As a listed company, the financial loss of Liangpin Store, especially the loss of industrial integration, is really great. "A person close to the good shop revealed.

According to "Guangyuan Juyi", it is impossible for two head enterprises in the discount snack industry, involving nearly 7,000 stores, with consolidated sales exceeding 7 billion in 2022 and current valuation of about 9 billion, to complete all the processes required for the merger in just 22 days, such as due diligence, negotiation, contract drafting, investor approval, etc., and judging from the clues such as the establishment time of the shareholding platform, the start and decision of the merger between the two parties took place in "Guangyuan Juyi" and "Zhao Yiming"."

Obviously, Zhao Ding deliberately concealed his real purpose from the good shop. Looking back now, Black Ant bought the shares of Zhao Yiming held by a good shop, and I don’t know if it is ready for the merger of snacks and Zhao Yiming. "The above person said.

The format of discount snacks began to expand rapidly in 2020. According to Huachuang Securities, the total number of discount snacks stores has exceeded 10,000 in 2020, and a pattern of regional brands standing side by side has been formed, such as Hunan snacks are busy, Sichuan and Chongqing snacks are famous, and Jiangxi Zhao Yi is famous.

Among them,Snacks have been busy for only five years, and the number of stores has exceeded 2,000, leading the industry, and a number of investors have gathered behind them, including Sequoia China, Gaorong Capital, Qicheng Capital and Mingyue Capital.

In July this year, it was reported that snacks were busy and intended to be listed on the mainland A-share market in China or Hongkong, and the fund-raising could reach 100 million to 200 million dollars. If you choose to go public in Hong Kong, you will have an IPO as early as 2024.

Although the follow-up, snacks are very busy in response to the rumors of listing: there is no clear listing plan and location. However, judging from its multiple rounds of financing and the acquisition of Zhao Yiming, the ultimate goal is to expand the scale of listing.

"Snacks Busy" and "Zhao Yiming Snacks" announced the completion of the strategic merger on November 10th, with Yan Zhou, the founder of Snacks Busy, as the chairman of the new group. At this point, the two head players came together at the discount snack track, which attracted a lot of capital and media attention.

According to the public information of Tianyancha, Zhao Ding holds 32% of the shares in the merged entity of Busy Snacks/Zhao Yiming, which is the second largest shareholder in the company after Yan Zhou, and concurrently serves as the director of the company and the CEO of Zhao Yiming.

Coincidentally, on November 10th, China Securities Regulatory Commission just released the latest opinion draft explanation on the regulation of IPO guidance for A-shares, which clearly stated: "In order to promote the establishment of honesty, self-discipline and legal awareness of the actual controllers and directors of the company, and improve the quality of listed companies from the source", the reputation of the actual controllers, directors, supervisors and senior managers of the company to be listed will become the focus of IPO audit.

With the complaint filed by Liangpin Shop, there is no doubt that the honesty, contractual spirit and even legal consciousness of the second person of the new company have been publicly questioned.

It should be noted that Liangpin Store has made it clear that it has filed a lawsuit against Zhao Ding on the grounds of "deliberately concealing important matters of the company and damaging the right of minority shareholders to know".

"If the good shop wins the case, Zhao Ding and even the snacks after the merger are very busy and may face huge compensation, and the merger that has been negotiated may also be forced to cancel."

From the perspective of the listing prospect, the clear and stable equity, whether there are disputes and potential risks are the key points of the listing review of the CSRC. From the recent cases that Honey Snow Ice City and Laoxiang Chicken are difficult to list, it can be clearly seen that the red and yellow light policy of the CSRC has strict restrictions on the industry.

"Therefore, regardless of the outcome of the lawsuit, snacks are very busy. Under the multiple influences of the restrictions imposed by the CSRC and the reputation crisis of the company’s No.2 key person, the road to listing has been bumpy."The above-mentioned relevant person told reporters.

If snacks are too busy to be listed in Hong Kong stocks, they still need to be filed with the China Securities Regulatory Commission before filing, and the CSRC will still review domestic companies planning to list in Hong Kong. The Hong Kong Securities Regulatory Commission (CSRC) also has clear requirements on the clarity, stability and non-equity disputes of listed companies. At that time, both the litigation disputes with good products and the reputation of key people in the company will become the focus of the CSRC’s key review.

According to the reporter’s understanding, as early as before the merger of Busy Snacks and Zhao Yiming, there were investors arguing about Busy Snacks and the investment value of Zhao Yiming.

LP, an organization with knowledge of the situation, revealed to reporters:"As early as May this year, Zhao Yiming began to communicate with potential investors for a new round of financing. The company expanded aggressively this year, and the capital chain behind it has been in a tight state. Several head funds contributed by us have basically pass after all the adjustments. As soon as this complaint came out, even the expectation of withdrawal was gone, which is a common concern of investors. "

The source said, "Snacks are very busy and Zhao Yiming is planning to list on the Hong Kong stock market. However, investors know clearly that such a target land will basically have no liquidity after the listing of Hong Kong stocks. "

In the past two years, Hong Kong stocks have been an important choice for consumer goods companies to go public. Brands such as Pot Circle, October Paddy Field and Youbao Online have all been successfully listed on the Hong Kong Stock Exchange, and companies such as Chabaidao have already submitted their watches to the Hong Kong Stock Exchange. Some companies that have previously hit A-share IPOs, such as Yanzhiwu, Lancang Ancient Tea, Laopu Gold and Mengjinyuan, have also moved to Hong Kong stocks. However, the liquidity problem of Hong Kong stock market has always troubled investors.

A good reference is the pot circle that has just been listed in Hong Kong recently, with a daily turnover of less than HK$ 1 million; Two years ago, hellens and Naixue, which enjoyed unlimited scenery, now have a daily turnover of only a few million Hong Kong dollars, and their market value has dropped by more than 70% compared with their respective highs; Wei Long used to be valued at 70 billion, but now the market value of Hong Kong stocks is 17.7 billion, and the daily turnover is only several hundred thousand. In other words, shareholders, including investors and employees, can’t sell stocks at all.

"Snacks are busy and the share ratio of Zhao Yiming investors’ shareholders is already very high. After the merger, the share ratio of investors is close to 15%, and the accumulated investment cost is nearly 600-700 million. According to the liquidity of several million Hong Kong dollars a day, even if it is sold every day, investors will have to reduce their holdings for several years before they can return to their capital. If you add employees and founders to reduce their holdings, you don’t know when to sell them. Once investors and founders start to reduce their holdings, the market value of the company will inevitably fall sharply. "

"So, even if snacks are busy and successfully listed in Hong Kong stocks, such projects are superficial. Whether an investment institution can sell it back is a problem, not to mention LP making money. "The LP investor admitted to the reporter: "As an LP, in the current environment, we definitely look at liquidity and DPI. Projects that are both illiquid and difficult to quit are very dangerous and can’t be touched at all. If the funds we invest in only focus on book returns and reputation, it will be a trust injury to the whole industry. "

When Snacks Busy merged with Zhao Yi Mingguanxuan, it was declared that "the two sides will learn from each other’s strong points and integrate deeply … to jointly empower franchisees and contribute to the healthy development of the industry …" Now, it seems somewhat ironic.

"In fact, before the busy merger with snacks, Zhao Yiming’s financial stability has always been an element of concern and concern for franchisees. Regardless of the rapid expansion of cost, how long can Zhao Yiming’s tactics of subsidizing burning money last? Everyone has a question mark. Although it is very busy to merge with snacks, it is now facing a lawsuit from a good shop. If it cannot be listed in the future and investors ask the company to buy back shares in cash, there may really be a capital chain crisis, which will lead to a sudden interruption of the subsidy for burning money. "

According to Zhao Yiming’s internal staff, "Snacks are very busy and both Zhao Yiming have made employee incentives through the employee stock ownership platform, allocating equity to employees and emphasizing the cash value brought by equity after listing." Nowadays, with the background of a series of events exposed by the lawsuit of defending the rights of good shops, after the hope of listing is slim, the equity incentives that employees strive for may be dashed.

The core of enterprise management is "people", and enterprise management often takes equity incentive as the weight to retain talents. When employees regard enterprise development as their goal, who should pay for those promises that are overhead? If the capital chain is broken, how can the subsidy policy promised to franchisees be guaranteed? And how to realize the small and medium-sized brands acquired with equity value?

In the past two years, snacks started in Changsha, Hunan Province were very busy, and snacks from Zhao Yiming, which came out of Yichun, Jiangxi Province, attacked the city all the way, opening more than 4,000 stores and more than 2,500 stores respectively. With the arrival of the merger, the number of the two stores added up to nearly 7,000. This involves most employees, suppliers and franchisees. If Zhao Yiming really cheats for his own interests, how can he be honest with franchisees?

Actually, Snacks Busy and Zhao Yiming, as two large-scale enterprises in the hot industry, have made outstanding contributions in the development of the industry. Perhaps their initial intention is just a commercial contest, but they may lack some understanding of laws and regulations. As a listed company, Liangpin Store is indeed its due obligation to safeguard the rights and interests of its own shareholders and shareholders.

In today’s market environment, we all hope that more enterprises and investors will have a positive voice, sit tight and create a more honest and fair market environment, so that the industry can continue to develop in a healthier direction. Regarding this lawsuit, we will also continue to pay attention to the follow-up development.

Rongzhong official fan base

END